The Dell family’s investment powerhouse: DFO Management’s journey to prominence

Founded at the dawn of the millennium by Mr Dell himself, DFO Management (formerly MSD Capital) has emerged as a prominent player in the world of family offices. With a focus on generating superior, risk-adjusted returns across a diverse portfolio, the company has earned a reputation for its strategic investments in various asset classes, making it a well-recognised name in the financial industry.

DFO Management, formerly known as MSD Capital, is the single-family office of Michael Dell, the founder and CEO of Dell Technologies, and his family. It is one of the largest family offices globally, with over $31 billion in assets under management.

About the Company

DFO Management

- Location United States

- Type Single Family Office

- Founded 1998

- Services Wealth management

The structure of MSD Capital family office

DFO Management, formerly MSD Capital, is the private holding and investment management firm of Michael Dell, the founder, chairman, and CEO of Dell Technologies, and his family. The firm was founded in 1998 and is based out of New York City, New York with offices in Santa Monica, California and West Palm Beach, Florida.

It is structured as a single family office under the leadership of:

- Gregg Lemkau, Chief Executive Officer – Lamkeu joined MSD Capital in 2021, having previously served as the co-head of the Investment Banking Division at Goldman Sachs.

- John Pelan, Chairman Emeritus – The co-founder of MSD, Pelan previously served as a Principal at ESL Partners and as a Vice President at the Equity Group.

- Marc Lisker, Chief Legal Officer – He joined MSD in 1999 and previously served as an associate in the Corporate and Securities Group at Mayer Brown LLP.

- Alisa Mall, Chief Investment Officer – She joined DFO Management in 2022 and is an ex-managing director of Corporate Strategy at Foresite Capital, a biotech-focused venture capital firm based in San Francisco.

MSD Capital’s investment strategies focus on generating superior, absolute risk-adjusted returns across a diverse portfolio over the long term.

MSD Capital's investment strategies, equity stakes and real estate ventures

DFO Management utilises multifaceted investment strategies to create and develop a diverse portfolio of various asset classes.

The firm’s most significant equity stakes in public companies are Hayward Holdings, Inc., PVH Corp. and Dine Brands Global. PVH Corp. is one of the largest apparel companies in the world that owns a number of well-known subsidiaries like Calvin Klein, Tommy Hilfiger, Van Heusen, Izod, Arrow, and Speedo and is currently valued at $5.59 billion with 5.9% return on equity (ROE). DFO Management owns over 256,000 shares of this company. Dine Brands Global is a food and beverage company that owns and operates two full-service restaurants including Applebee’s Neighbourhood Bar and Grill, and the International House of Pancakes. DFO Management is the majority shareholder of this The firm owns over 3.92 million shares of the company and an approximate 21 percent stake in the company.

Asbury Automotive was another significant equity stake for DFO Management which it exited in 2017, liquidating its remaining 1.7 million shares at $67 per share.

DFO Management bought the Four Seasons Resort, Maui in 2004 in a massive $280 million buyout. However, the resort faced numerous financing difficulties in remitting its annual debt in the coming years. In 2010, DFO Management had to disburse $12 million to help payout its $23.6 million annual debt service. The firm managed to successfully refinance the resort in 2011. The firm doubled down on its real estate investment by buying out the Four Seasons Resort in Hualalai in 2006 by partnering up with Rockpoint Group Joint Ventures.

In July 2016, the family office partnered with TF Cornerstone to buy a 90% stake in the air rights above Grand Central Terminal in a deal worth $126 million. In 2018, the two firms sold 680,000 square feet of their owned 1.35 million to JP Morgan Chase for $350 per square foot, amounting to a consolidated buyout of $238 million. The deal resulted in a net profit of $90 million for DFO Management and TF Cornerstone.

In September 2016, DFO Management partnered with TruAmerica to acquire three Las Vegas, garden-styled, multi-family communities in Southern Nevada. The next year, the two firms expanded their partnership to acquire a 640-unit multi-family community Sienna at Vista Lake in a deal worth $66 million.

The family office has also participated in a number of major acquisitions. In 2009, it joined 6 other private equity groups to buy the remaining assets of IndyMac Bank, a failed institution that crumbled during the 2008 economic crisis, in a deal worth $13.9 billion. The bank was later renamed the OneWest Bank. In 2013, MSD played a key role in the acquisition of Dell Inc., by Michael Dell and Silver Lake in a deal worth $24.4 billion. It was also instrumental in negotiating the $60 billion merger of Dell Inc., with EMC in 2016. In the same year, DFO Management joined a consortium led by WME-IMG to participate in the $4 billion acquisition of the Ultimate Fighting Championship (UFC).

For the like minded investors - MSD Partners

Founded in 2009 by the principals of MSD Capital, MSD Partners operates as a separate investment advisory firm for like-minded, external investors to invest in the same strategies developed by MSD Capital, alongside the Dell family. In January 2023, MSD Partners merged with Byron’s Trott’s merchant bank, BDT & Company to form BDT & MSD Partners.

Apart from its role as an independent investment advisor, BDT & MSD Partners focuses on building an optimised portfolio around four key asset classes: private capital, credit, growth equity, and real estate.

The firm’s private capital strategy primarily involves control buyouts, structured equity, and significant minority stakes, with the flexibility for long-term investments in family- and founder-led businesses. Since 2010, BDT & MSD Partners has deployed more than $50 billion across its investment strategies.

The credit strategy provides financing solutions to a wide range of businesses across various market sectors by investing in liquid corporate credit, with a focus on long-term partnerships.

The firm invests in high-growth, founder-led technology, consumer, and healthcare companies with proven business models and large market opportunities.

Finally, the real estate fund. The primary focus of the firm’s real estate strategy is investing in complex, large-scale, and high-quality real estate assets in high barrier-to-entry locations. MSD Partners’ real estate portfolio comprises 30 assets with an approximate portfolio value of $10 billion.

BDT & MSD Partners is one of the largest single family offices in the world with more than $31 billion in assets under its management (AuM), $91 billion in revenue, and over $17 billion in profits in the period between its establishment in 1998 and 2019.

Further Reading

Peter Thiel’s capital stack: A contrarian view for family offices

InvestmentsPeter Thiel is one of Silicon Valley’s most influential and polarising figures. A billionaire investor, PayPal co-founder, and early Facebook backer, he is also the driving force behind Palantir and Founders Fund. Known for his contrarian worldview and libertarian ideology, Thiel has built a layered approach to managing his wealth. His method blends operating companies, […]

From fragmentation to focus: A $200M portfolio transformation

Technology StacksA UK-based multi-generational single-family office managing over $200 million faced challenges managing its complex portfolio spread across multiple continents and assets. As their sophisticated investments exceeded the limits of their operational infrastructure, they partnered with IQ-EQ to develop a tailored solution. This case study outlines how IQ-EQ helped them shift from a reactive to a […]

The hidden drains on family office portfolios and how to stop them

Listed Stocks & BondsWhen Greenlock started working with funds, a single-family office client asked them to audit their structure. At first, everything looked standard — until they stumbled upon a curious share class. The minimum investment was just $10k, designed for plain-vanilla retail investors with the highest regulatory protection and enormous embedded retrocessions. Clearly, it was not a […]

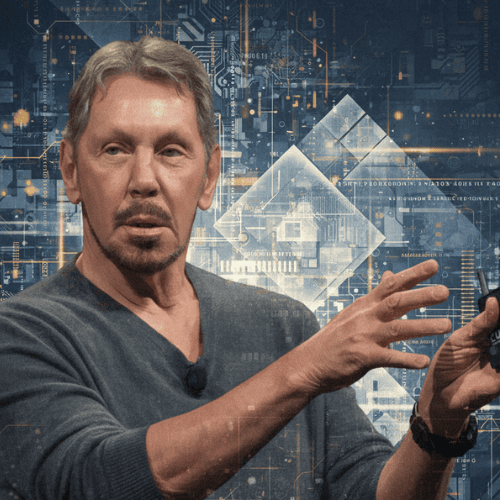

Larry Ellison: The unconventional billionaire and his family office

LeadershipLawrence Joseph Ellison is one of the world’s most enigmatic billionaires. As a two-time college dropout and a personal friend of the late Steve Jobs and Elon Musk, he has built a reputation for his bold, unconventional approaches to business and lifestyle. As the founder and former CEO of Oracle Corporation, he has chartered a […]